Black Sea Initiative Success & Status

The Black Sea Initiative has allowed for the safe export of over 30 million metric tons (MMT) of grain and foodstuffs from Ukraine since initial agreement in July 2022, according to the United Nations. As of May 11, 2023, 50% of the total grain and foodstuffs cargo exported through the program has been corn, the grain most affected by blockages at the beginning of the war. Officials from United Nations, Ukraine, Turkey, and Russia are meeting this week in pursuit of extending the agreement beyond the approaching expiration date on May 18, 2023.

The grain corridor has accounted for 25.2 MMT, or 50% of Ukraine’s 52.9 MMT total grain and oilseeds shipments from July 2022 to March 2023. Three ports on the Danube River provide another increasingly used pathway for grain exports from Ukraine, accounting for 22% of grain and oilseed exports in that time frame. Ukraine now exports 1.5 million tons of grain monthly on the Danube, and expansion of a river canal should allow for an additional 500,000 metric tons each month, or 6 MMT per year.

Without an extension, Ukraine’s ability to export corn and other grains from ports that are part of the deal would be restricted. But alternatives exist, such as expanded potential for exports via the Danube. The fate of the Black Sea Grain Initiative may impact Ukraine’s export potential. Further impacting export potential are unknowns about planted area and production for 2023.

Ukraine As a Global Corn Exporter

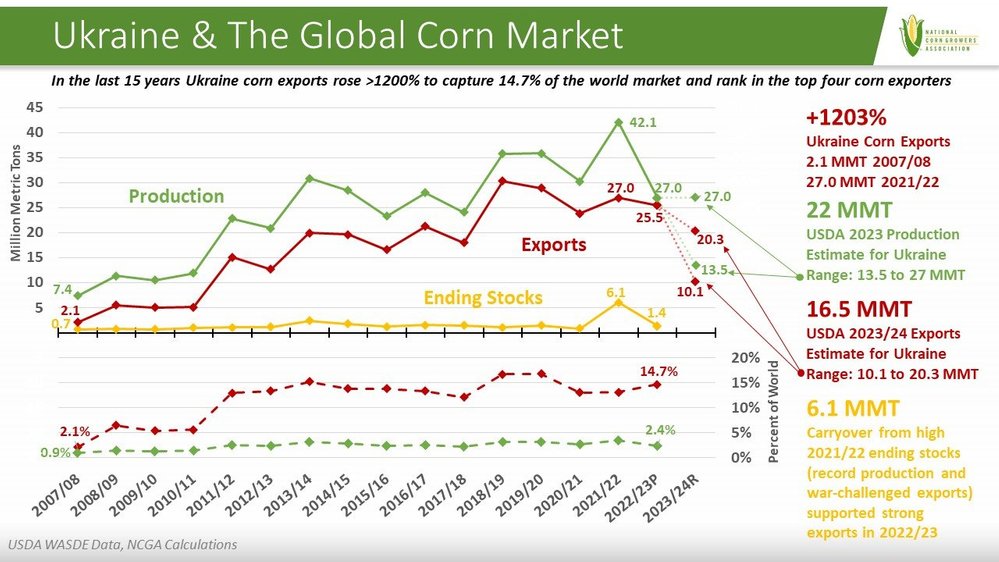

Ukraine produced a record 42.1 MMT of corn in 2021, representing more than 400% growth in production in the fifteen-year period from 2007 to 2021. Even more significant is the growth in corn exports over the same period, rising from 2.1 MMT to 25-30 MMT in recent years. That translates to more than 1200% growth in exports as an increasing portion of the corn produced in Ukraine has been exported over time. Although Ukraine produces less than 4% of world corn in recent years, the nation has remained among the world’s top four largest corn exporters contributing 13% to 17% to world trade.

Corn exports as a percent of production trended upward from 28% in 2007/08 to around 80% in the three years leading up to the Russian invasion. After Russia invaded Ukraine in February 2022, corn exports were stalled for a few months until the Black Sea Grain Deal allowed exports to resume. The 27 MMT exported in the 2021/22 marketing year represented 64% of production, falling short of the approximately 80% of production exported in recent years that may have been expected to continue in a non-war scenario. This resulted in 2021/22 ending stocks at 6.1 MMT, significantly higher than normal ending stocks range over the past one and half decades.

War zone complications reduced planted and harvested acres last year, resulting in a 36% decline from the 2021 pre-war record corn production to 27 MMT of corn in 2022. Despite the lower production level, Ukraine is on track to export 25.5 MMT of corn in the current 2022/23 marketing year, supported by higher beginning stocks carried over from the previous year. With that level of exports, Ukraine will end the 2022/23 marketing year with ending stocks at 1.4 MMT, in line with the nation’s normal stock levels.

Ukraine 2023 Production & Exports

In the May World Agriculture Supply & Demand Estimates report, USDA projects Ukraine will produce 22 MMT or corn, an 18.5% drop from last year’s already reduced level. The projection for exports is 16.5 MMT, or 75% of production.

Ukraine remains a war zone, making it difficult to predict 2023 production. Given the cost of production compared to other crops and continued war related challenges, corn production is expected to be lower as USDA projections indicate. Even in a best-case scenario, it’s unlikely production could exceed 2022 production of 27 MMT, so that could be considered the maximum end of a possible production range for 2023. At 75% of production, exports would be 20.3 MMT in the maximum scenario.

On the other hand, a recent survey of 3,000 farmers in Ukraine indicates farmers may only plant half of the corn acres planted in 2022. If production were also half of last year at 13.5 MMT, exports at 75% of production would be 10.1 MMT. This likely represents a minimum scenario.

While exports near USDA’s mid-range estimate for Ukraine corn exports is most likely, the range between the maximum and minimum scenarios represents a possible fluctuation equivalent to more than 5% of total world corn exports.

Ramifications for U.S. Farmers

A wide range of possible corn production levels in Ukraine translates to a wide range of possible export levels for the nation. Pair that with the unknown fate of the Black Sea Grain Deal, and there is a lot of uncertainty in the world market for corn in the 2023/24 marketing year. As U.S. corn exports fall behind the pace of recent years in an increasingly competitive global market, U.S. farmers may be expected to fill the void left by the ongoing war in Ukraine.